Asset Turnover Ratio Standard

Asset Turnover Ratio 100000 25000. The ratio obtained by dividing quick assets by current liabilities is called.

Asset Turnover Ratio Formula Calculator Excel Template

Likewise companies having too high a current ratio relative to the industry standard suggests that they are using.

. Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets. Asset Turnover Ratio Formula Example 2. A high turnover may indicate unfavourable supplier repayment terms.

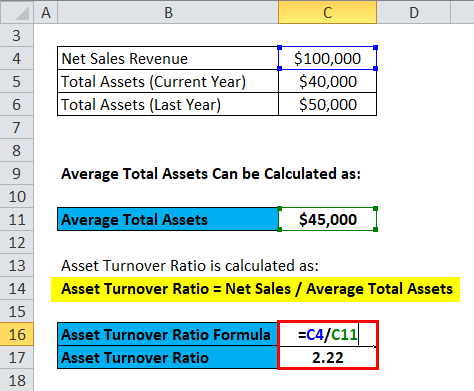

The higher the turnover the shorter the period between purchases and payment. Asset Turnover Ratio is calculated as. Asset Turnover Ratio 4.

D Stock turnover ratio. Asset Turnover Ratio Net Sales Average Total Assets. Let us take the example of a company to demonstrate the stock turnover ratio concept.

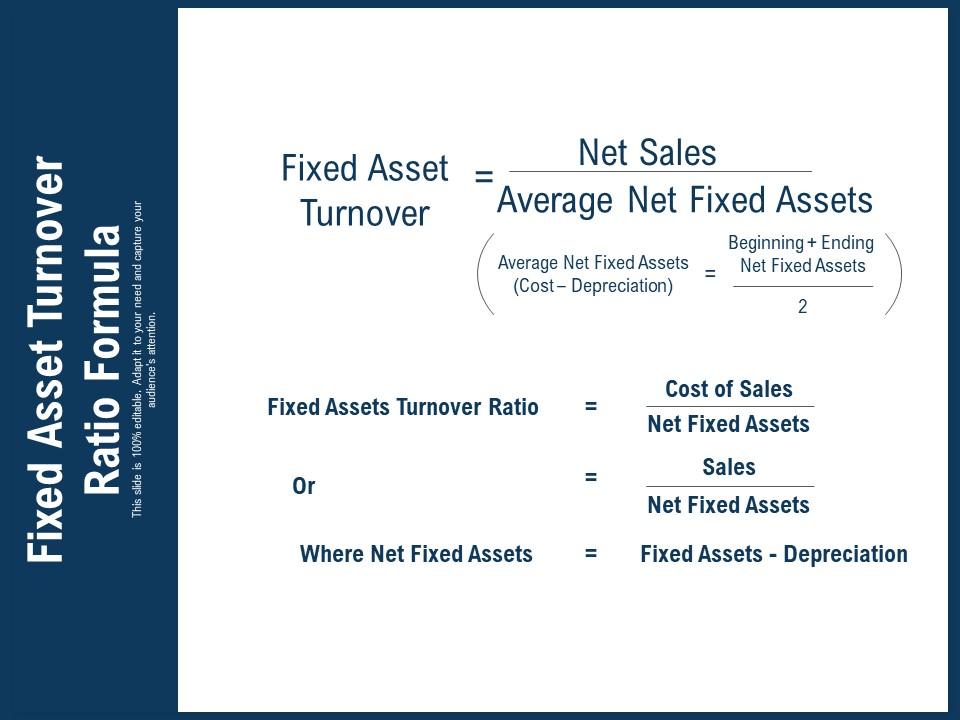

Total Asset Turnover Revenue Average Total Assets Fixed Asset Turnover. Even during the current low-yielding market environment the fund delivered a 425 yield over the past year through November 2021 and its volatility measured by standard deviation was 13. Portfolio Turnover Ratio.

D None of these. Compare your days in accounts payable to supplier terms of repayment. This indicates that for company X every dollar invested in assets generates 4 in sales.

A Solvency ratio b Turnover ratio c Acid test ratio. Trade payables turnover ratio or Accounts payable turnover ratio depicts the efficiency with which the business makes payment. To calculate your accounts receivable turnover ratio divide your net sales by your average gross receivables.

It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue. Both fixed asset as well as total asset turnover ratio for Motorola was higher than the industry average. A low turnover may be a sign of cash flow problems.

Search Quotes News Mutual Fund NAVs. This suggested that the company was using its assets more efficiently as compared to the industry for generating sales. This ratio is used to measure the number of times the business is paying off its creditors or suppliers in an accounting period.

The higher the ratio the better is the companys. Calculating Accounts Receivable Turnover. Thus asset turnover ratio can be a determinant of a companys performance.

During 2018 the company incurred the raw material cost of 150 million the direct labor cost of 120 million and the manufacturing overhead cost of 30 million. Accounts payables are short term debts that a business owes to its suppliers and creditors. The ratio of shareholders funds to total assets of the company is called.

Asset Turnover Ratio Formula Calculator Excel Template

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Comments

Post a Comment